cfd trading malaysia

Cfd trading malaysia

Contracts for difference can be used to trade many assets and securities, including exchange-traded funds (ETFs). Traders will also use these products to speculate on the price moves in commodity futures contracts such as those for crude oil and corn Versus Trade. Futures contracts are standardized agreements or contracts with obligations to buy or sell a particular asset at a preset price with a future expiration date.

This website is not directed at UK residents and falls outside the European and MiFID II regulatory framework, as well as the rules, guidance and protections set out in the UK Financial Conduct Authority Handbook.

CFDs make use of the ‘gearing’ or ‘leverage’ principle. This enables investors to increase their percentage return and losses, on investments. You get leverage when you only have to put down a small amount of money to control a much bigger position.

CFD commissions are only applicable for CFD shares. Therefore, opening and closing positions are commission-free for all forex, indices, commodities and treasuries instruments (other fees and charges apply). CFD share trades attract a commission charge for each trade. UK share trades cost 10 basis points (0.10%) with a £9 minimum commission charge per trade.

Bitcoin cfd trading

The most common CFD pairing is with the US dollar – for example, BTC/USD. Admirals offer the option to trade various digital currency CFDs with EUR, as an alternative to USD, as well as trading with digital currency cross pairs.

Yes, CFD trading is a regulated industry. To comply with regulations you must have your account verified to trade. Verification will usually involve providing proof of identity and address, such as a passport and a driver’s license, along with a utility bill. You will often be asked to provide a selfie holding one of your photo IDs. You must make sure that it meets the required standards to pass.

Yes – You can speculate and hence trade on the rising and falling (Long or Short) of the Bitcoin price by purchasing and trading CFDs (Contracts for Difference). Please note, buying a Bitcoin CFD is not buying the underlying asset of Bitcoin itself, only the contract on the price direction (Buy or Sell).

For example, MetaTrader 4 and MetaTrader 5 are thought to be crucial to any trader’s journey, given the extensive implementation options within the charts, live real data options, and flexibility in the date ranges (among other things).

1. This is a marketing communication. The content is published for informative purposes only and is in no way to be construed as investment advice or recommendation. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and that it is not subject to any prohibition on dealing ahead of the dissemination of investment research.

Cfd meaning in trading

When you are trading contracts for difference (CFDs), you hold a leveraged position. This means you only put down a part of the value of your trade and borrow the remainder from your broker. How much of the value you are required to put down can vary. Remember, that leverage magnifies both profits and losses.

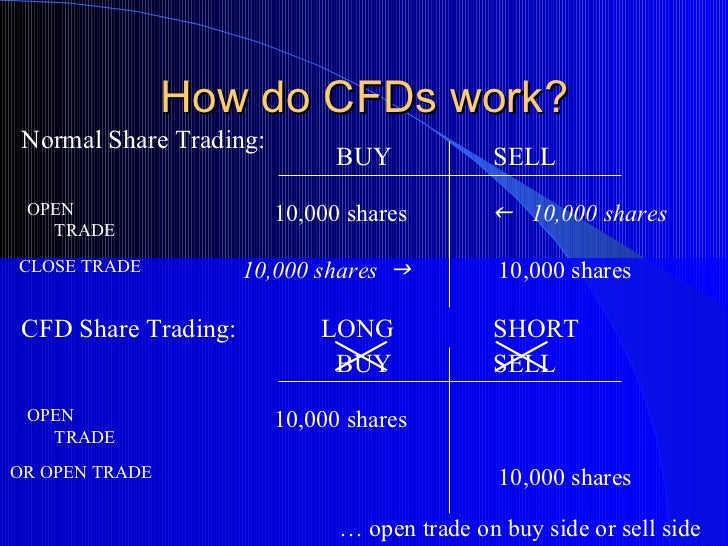

In conclusion, CFD trading is a form of derivative trading that allows traders to speculate on the price movements of a wide range of underlying assets, without actually owning the assets themselves. CFD trading offers traders several advantages over traditional trading, such as the ability to go long or short, the use of leverage, and the ability to trade a wide range of underlying assets from a single platform. However, CFD trading involves a high level of risk, and traders should be aware of the risks involved before trading. Traders should also choose a reputable CFD broker, with low transaction costs and a user-friendly trading platform, to ensure a positive trading experience.

If you think the price of an asset will rise, you would open a long (buy) position, profiting if the asset price rises in line with your expectations. However, you would risk making a loss if the asset price falls.

Unfortunately, short selling in the traditional investing sense can be quite complex. You will need to arrange borrowing the stock or asset you wish to short, and you’ll need to find a buyer. There are also multiple fees and charges to consider.

When you are trading contracts for difference (CFDs), you hold a leveraged position. This means you only put down a part of the value of your trade and borrow the remainder from your broker. How much of the value you are required to put down can vary. Remember, that leverage magnifies both profits and losses.

In conclusion, CFD trading is a form of derivative trading that allows traders to speculate on the price movements of a wide range of underlying assets, without actually owning the assets themselves. CFD trading offers traders several advantages over traditional trading, such as the ability to go long or short, the use of leverage, and the ability to trade a wide range of underlying assets from a single platform. However, CFD trading involves a high level of risk, and traders should be aware of the risks involved before trading. Traders should also choose a reputable CFD broker, with low transaction costs and a user-friendly trading platform, to ensure a positive trading experience.

Cfd trading account

eToro is known for its social trading platform, eToro allows users to follow and copy the trades of successful investors. It offers a simple interface, a wide range of markets, and a demo account for practice.

CFD trading allows traders to be market agnostic. In traditional investments, one can only profit when the asset’s value increases. However, in CFD trading, going short enables traders to profit from market declines as well.

CFD trading allows investors to leverage their capital and provides many of the benefits of trading assets such as stocks, commodities, indices and crypto without actually owning the instrument or investing large sums of capital.

You profit from CFD trading by accurately predicting price movements, going long in rising markets, and going short in falling markets, leveraging both market directions for potential gains while employing effective risk management strategies.

The use of leverage in CFD trading can lead to significant losses. While it amplifies potential profits, it also magnifies the impact of losses, and traders can lose more than their initial investment.